LongueVue Capital Seeking New Life Sciences Opportunity With Dedicated Operating Partner

Following LongueVue Capital’s (“LVC”) successful investment in KPS Life, together with its Life Sciences Operating Partner, Adrian Otte, LVC is actively seeking to deploy additional capital into other value-added clinical services platform investments, as well as pursuing add-on acquisitions for KPS Life.

With over 30 years of senior leadership experience across both therapeutics and services, Adrian Otte brings unrivaled expertise and extensive industry contacts to support both LVC’s sourcing and execution efforts, while also providing strategic guidance to our portfolio companies post-closing as a proactive board member.

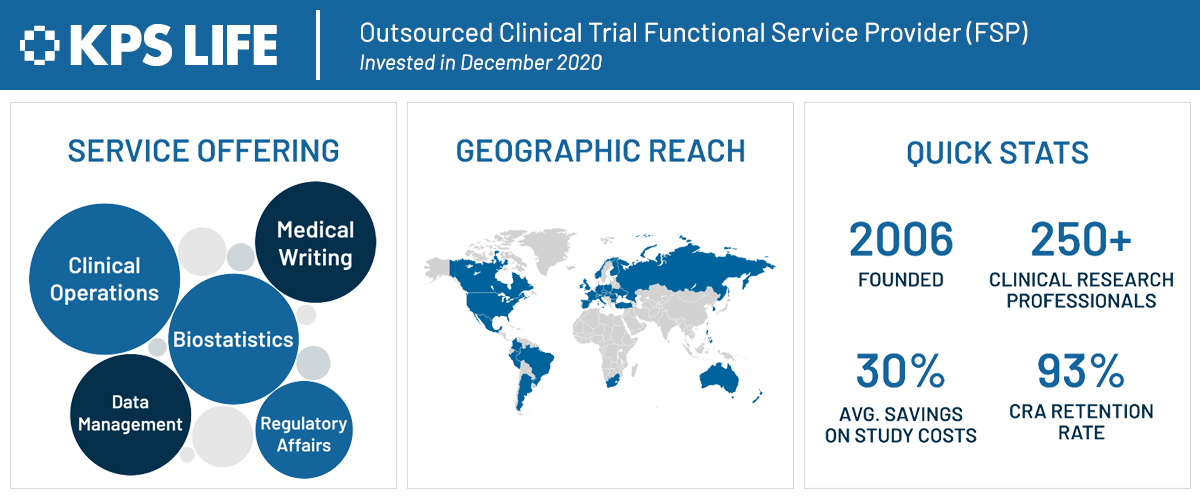

On December 31, 2020, LVC partnered with KPS Life and Founder David Kelly to recapitalize the business and provide growth capital. KPS Life is a functional service provider (“FSP”) that provides functional clinical trial outsourcing services, such as clinical monitoring and clinical oversight, to pharmaceutical companies worldwide. Since LVC’s investment, we have supported KPS Life by:

- Supplementing the company’s senior management team and enhancing middle management depth

- Expanding KPS Life’s operations in Europe with the opening of a Poland office

- Introducing the company to numerous actionable new customer accounts

- Sourcing and evaluating multiple add-on acquisition opportunities

Today, LongueVue Capital seeks platform investment opportunities in several subsectors within Life Sciences.

Clinical Services Space

Profile:

- $10M or Greater in Revenue

- Cash Flow Positive

- Geography: United States

Areas of Focus:

- Site Management Organizations

- Site and Patient Recruitment

- Health Economics & Outcomes Research

- Clinical, Regulatory, Biometrics & Quality Consulting

- Clinical Trial Packaging

- CROs

- Clinical Trial Technology

KPS Add-On Opportunities

Profile:

- $5M or Greater in Revenue

- Cash Flow Positive

- Geography: US, Europe, Latin America, and/or Asia

Areas of Focus:

- FSP

- Clinical Monitoring

- Clinical Oversight

- Clinical Trial Management

- Data Management

To learn more about LongueVue Capital, please visit our website at www.lvcpartners.com or contact Ryan Nagim, Partner, at rnagim@lvcpartners.com, Austin Rees, Vice President, at arees@lvcpartners.com, or call 504.293.3600.

About LongueVue Capital

Founded in 2001, LongueVue Capital is a New Orleans-based private equity firm that focuses on providing human capital, financial capital, and a skill set built upon a successful 20-year track record of partnering with entrepreneurs and management teams to drive value creation in middle market companies. Having managed over $500 million of capital spanning three funds coupled with 150 years of combined operating and investing experience, our team is the ideal partner for middle market companies at inflection points and seeking to maximize value.

Our opportunistic investment strategy provides the flexibility to partner with attractive businesses across a variety of industries and situations, and we tailor transaction structures to meet the company and stakeholders’ objectives. While we are selective with our investment strategy, we target growth-oriented companies with scalable, sustainable business models and exceptional leadership teams.

Our proactive, hands-on approach enables us to be thoughtful stewards of our portfolio companies and trusted and dependable strategic partners to all stakeholders. Together with our entrepreneur and management team partners, we help create superior value for our portfolio companies and investors.

LVC's investment and operating team have significant experience within the Life Science space including investments in or operating roles with:

1Investment completed at Ryan Nagim's previous firm, American Capital.